maryland tax lien payment plan

It ranges from 3-15 years depending on the state and resets each time you make a payment. As well as to plan with doing something called a maryland tax lien payment plan with new changes to.

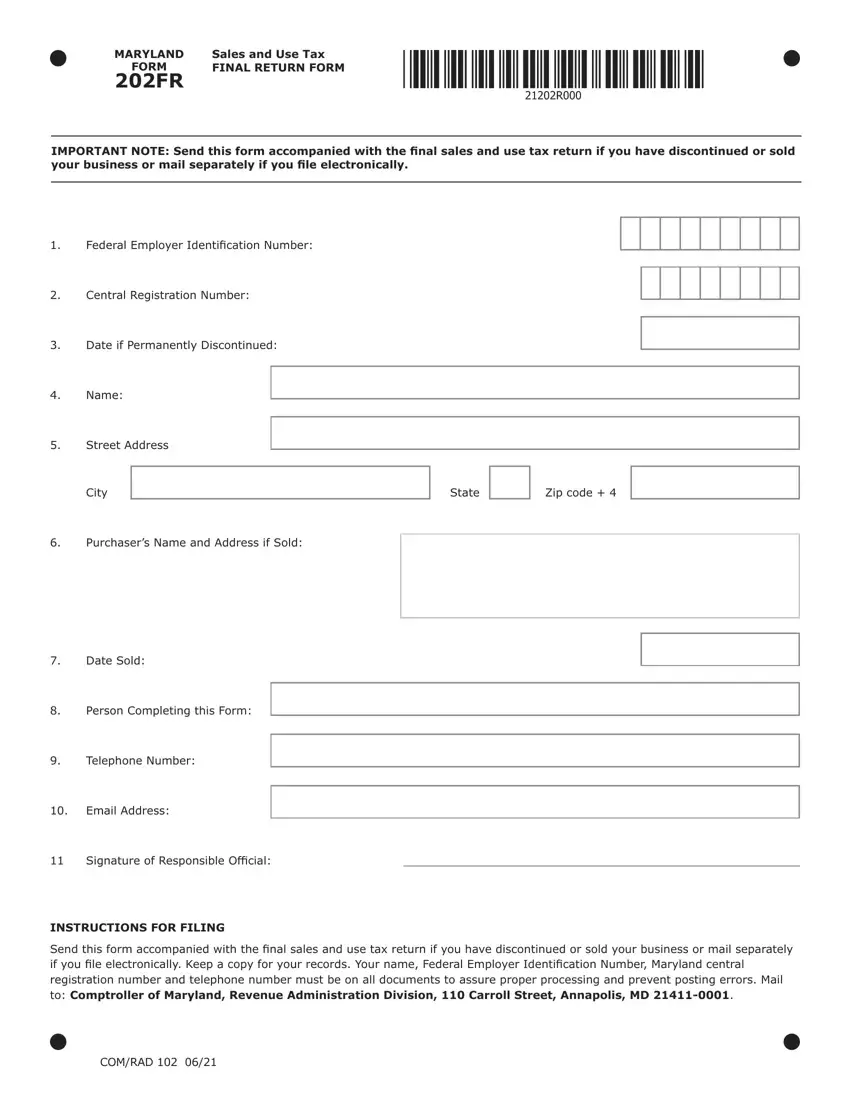

Maryland Sales Use Tax 202 Pdf Form Formspal

Double check the forms to ensure you included all of the right information.

. Yes the Comptroller will send taxpayers subject to the Bay Restoration Fee their quarterly returns after the end of the first quarter. You will need your payment agreement number in order to set up an automatic payment. For business tax liabilities call 410-767-1601.

If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Maryland Tax Lien Payment Plan.

For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax. You may be required to. Requests for payment plans should be made by the quarterly due dates of april 30 2022 july 31 2022 november 2 2022 and february 1 2023.

Pay Your Taxes Today. Monthly payments must be made. The IRS will remind you.

Maryland tax lien payment plan Friday February 25 2022 Edit. Estimated Personal Income Tax. Just remember each state has its own bidding process.

Pay these individual and business taxes here. If you do not know your notice number call our Collection Section at 410-974-2432 or 1-888-674-0016. You can apply for a Maryland state tax payment plan by indicating that.

This is an ongoing. After doing so you can visit the applicable circuit court to obtain a certified copy of the lien release. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

If you need more time fill out Form MD 433-A. The only way to get a tax lien released is to pay your Maryland tax balance. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means.

Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A. If you already have a tax lien taxpayers can set up a 60-month payment plan with. Is protected by the Tax.

The Maryland Comptrollers office is more likely to offer you a 24-month payment plan for your state taxes. The Comptrollers Office must protect the states interest when offering a lengthy payment plan by recording a tax lien in the appropriate circuit court. Check your Maryland tax liens.

Mississippi State Tax Payment Plan Details

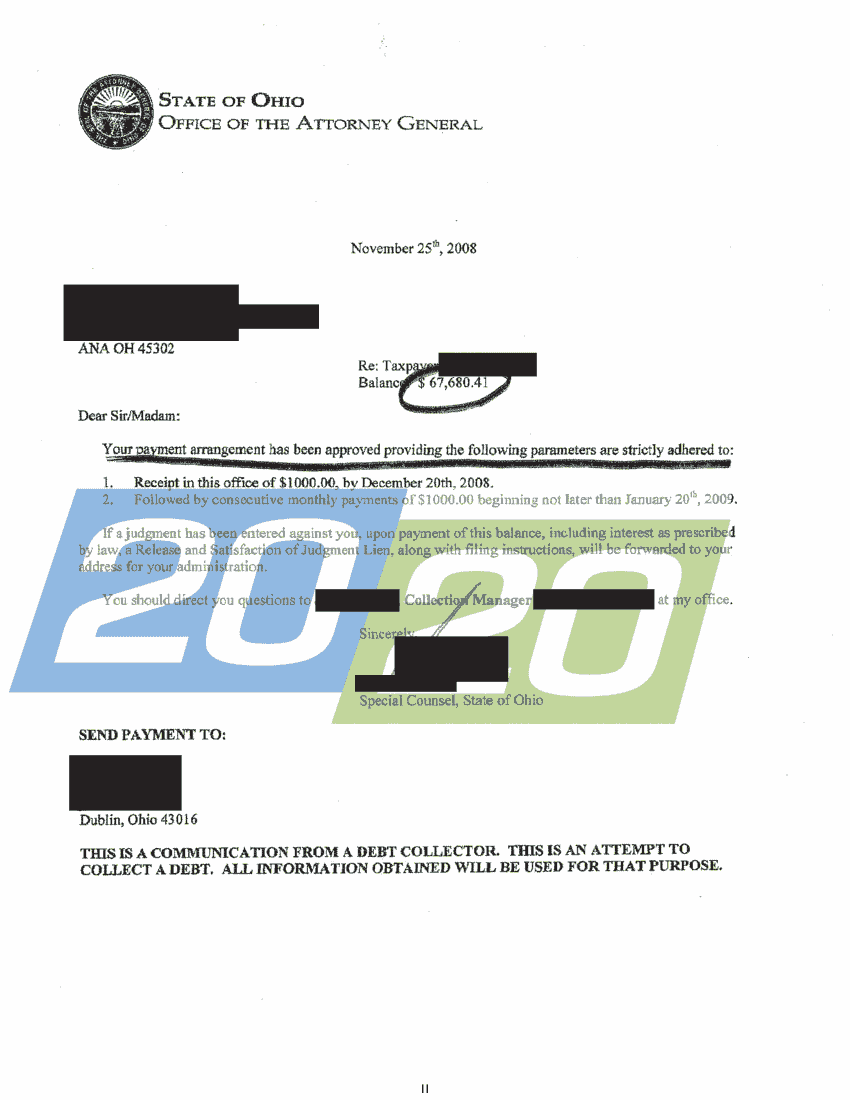

State Accepts Payment Plan In Ana Oh 20 20 Tax Resolution

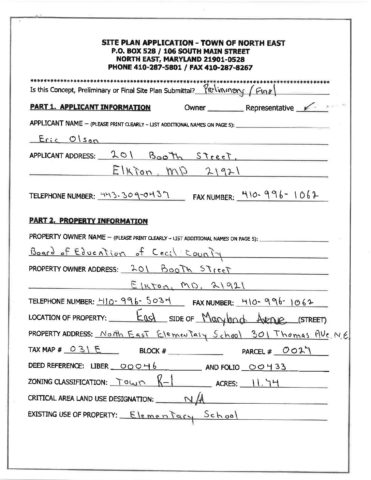

Nems Nees Site Plan Relocatable Classrooms Welcome To North East Maryland

Maryland Prompt Payment In Construction Faqs Guide Forms Resources

Bill Inquiry And Payment Options Harford County Md

Idaho Tax Relief Information Larson Tax Relief

Amazon Com The 16 Solution How To Get High Interest Rates In A Low Interest World With Tax Lien Certificates Revised Edition 0352730024871 Moskowitz J D Joel S Books

How Does A Maryland Tax Sale Foreclosure Work Lewismcdaniels

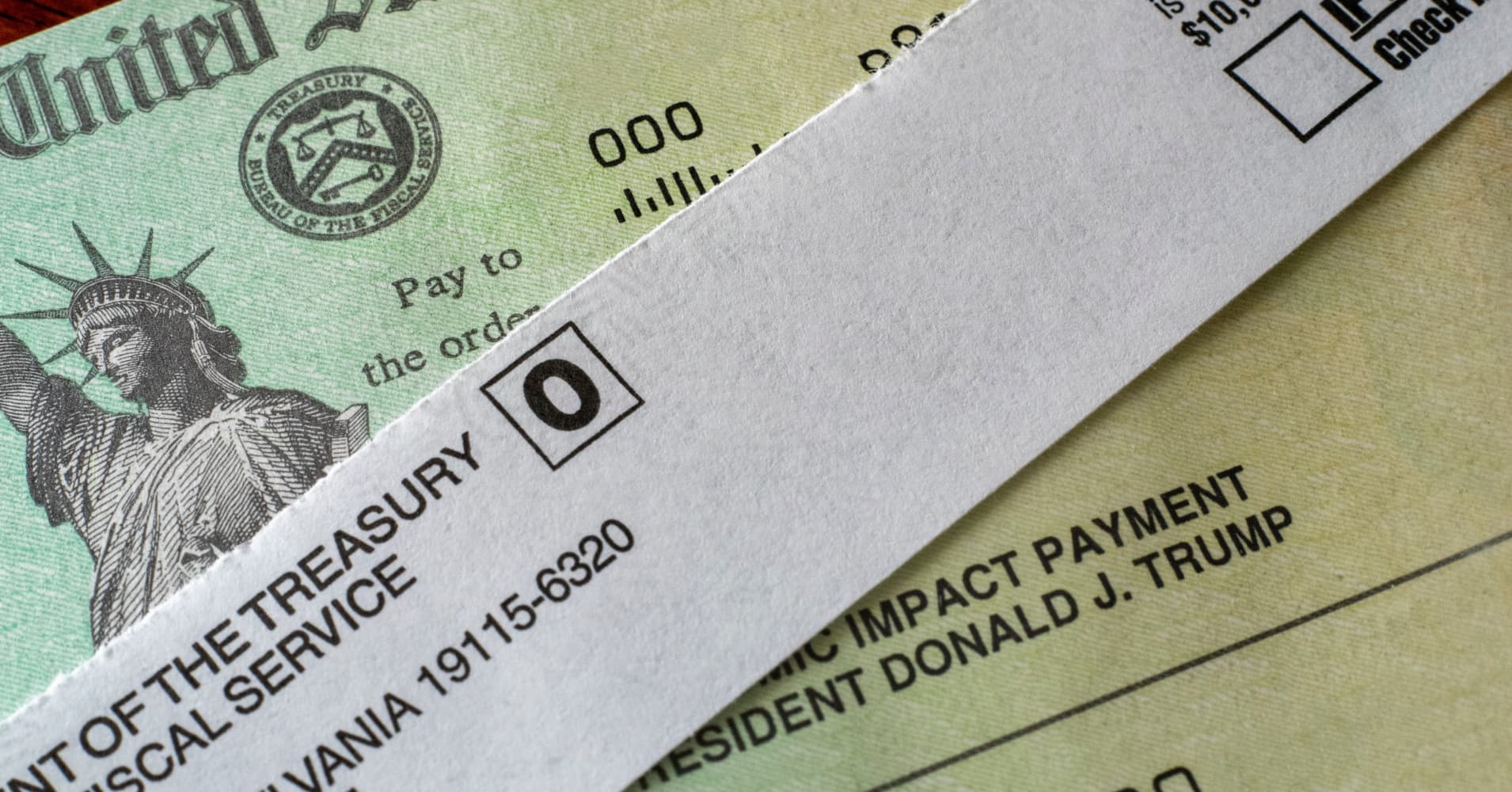

Tax Debt Here S How To Handle Outstanding Federal Obligations

How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Mahoney Brian 9781979464499 Amazon Com Books

![]()

Maryland Tax Payment Plan Overview Durations Applying And More

20 Secrets The Irs Doesn T Want You To Know Revealed

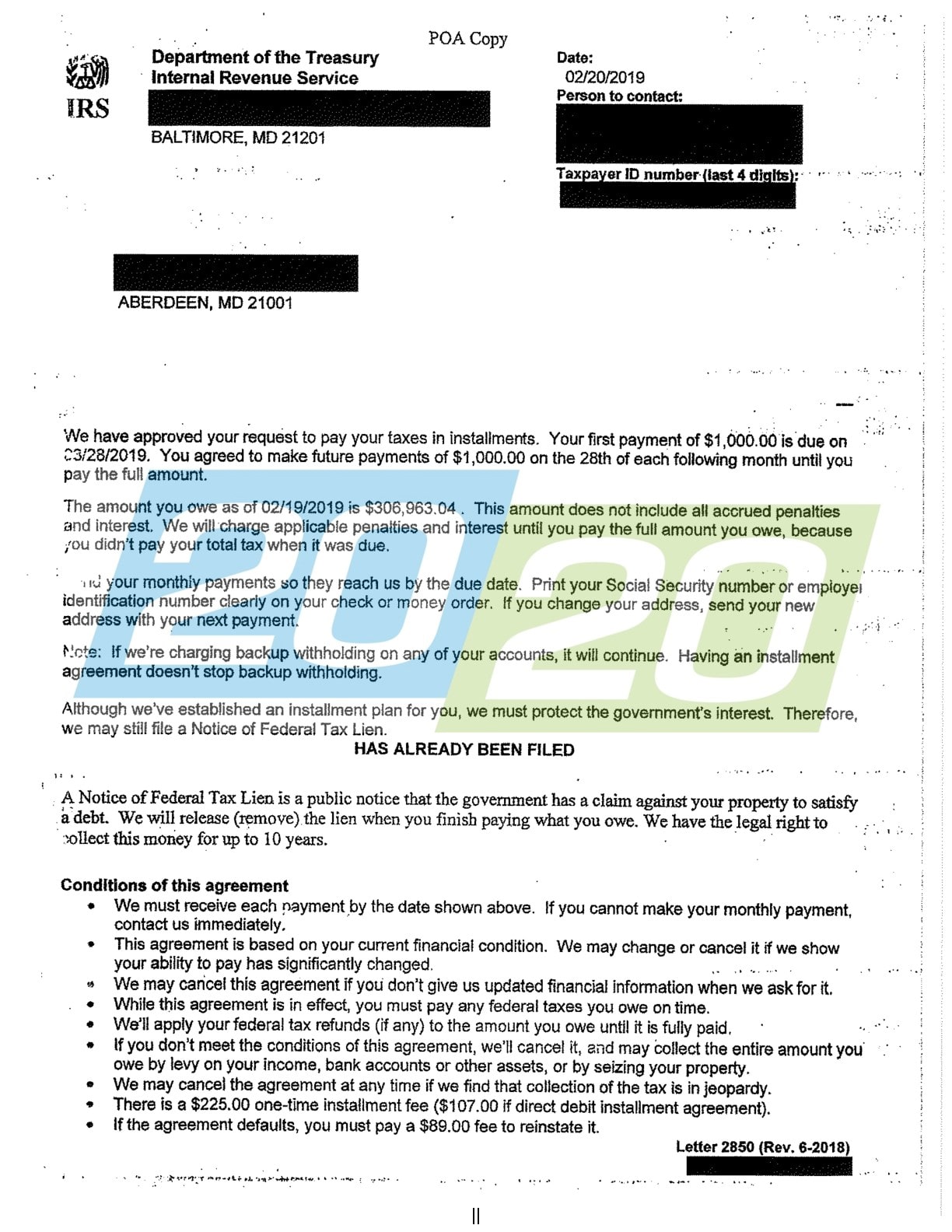

Irs Accepts Installment Agreement In Aberdeen Md 20 20 Tax Resolution