prince william county real estate tax assessment

Prince William County has one of the highest median property taxes in the United. Expert Results for Free.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Virginia Home.

. Dial 1-888-2PAY TAX 1-888-272-9829. Ad Download fax print or fill online Form RP-524 more subscribe now. Ad View public property records including property assessment mortgage documents and more.

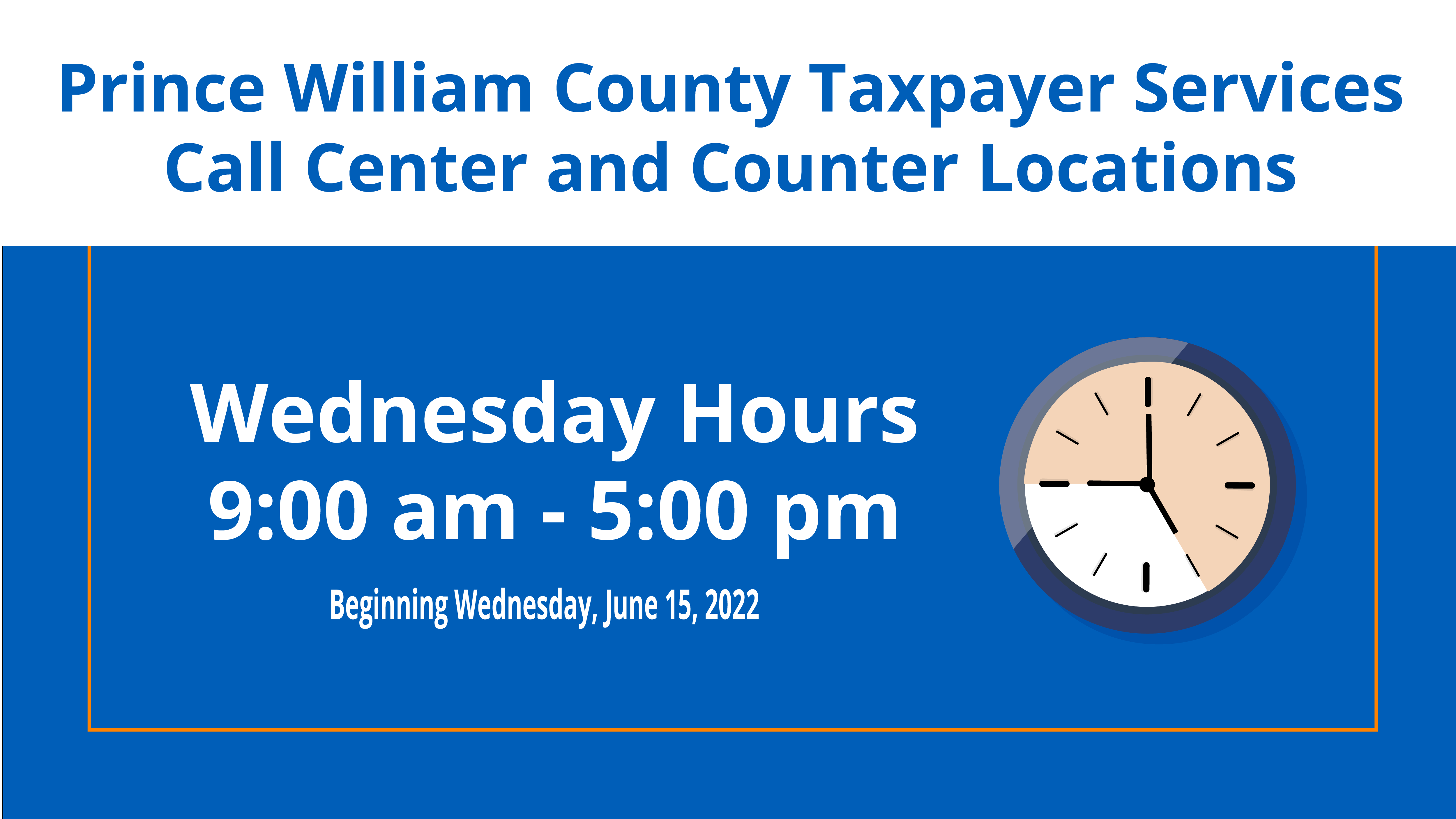

By creating an account you will have access to balance and account information notifications etc. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. In Prince William County Virginia the tax rate is 105 which is substantially above the state average.

Press 2 for Real Estate Tax. Use both House Number and House Number High fields. Hi the county assesses a land value and an improvements value to get a total value.

In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes. Free Comprehensive Details on Homes Property Near You. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

You can pay a bill without logging in using this screen. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and. Press 2 to pay Real Estate Tax.

To make matters worse for residential. Market value is the probable amount that the property would sell for if exposed to the market for a. The property tax calculation in Prince William County is generally based on market value.

Payment by e-check is a free service. Enter jurisdiction code 1036. Enter the house or property number.

If you have not received a tax bill for your property and believe. Business are also assessed a. Provided by Prince William County Communications Office.

July 2 2022. Enter the Account Number listed on the. Press 1 for Personal Property Tax.

Ad Just Enter your Zip for Real Estate Assessments in Your Area. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. A convenience fee is added to payments by credit or debit card.

All you need is your tax account number and your checkbook or credit card. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and. When prompted enter Jurisdiction Code 1036 for Prince William County.

This estimation determines how much youll pay. Press 1 to pay Personal Property Tax. If you have questions about this site please email the Real Estate.

Enter the Tax Account numbers listed on the billing. Find property records tax records assets values and more. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. You can contact the.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Real Estate Taxes Due July 15 2022

Volunteer Opportunities Sorted By Job Title Ascending Prince William County

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

The Rural Area In Prince William County

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William Wants To Hike Property Taxes Introduces Meals Tax

The Rural Area In Prince William County

Data Center Opportunity Zone Overlay District Comprehensive Review

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

New Hours For Taxpayer Services Call Center And Counter Locations

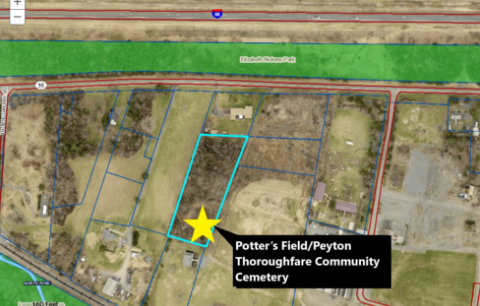

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

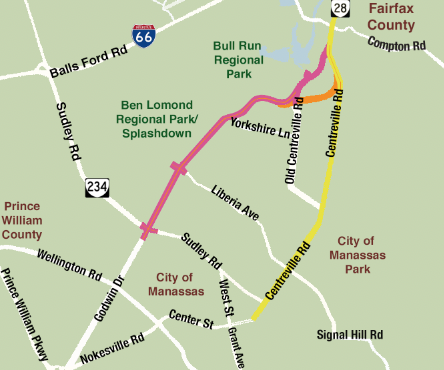

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com